Singapore Variable Capital Fund – Previously, most investment funds in Singapore were domiciled in the Cayman Islands. To bolster its position as an asset management hub and increase the amount of assets under management in Singapore, the Accounting and Corporate Regulatory Authority, together with the Monetary Authority of Singapore (MAS), launched the Variable Capital Company (VCC) scheme on January 15, 2020. This initiative aims to attract global funds to be domiciled in Singapore.

Singapore is a stable country with a strong rule of law, attracting many global headquarters to set up their command and control functions for the Southeast Asian region. The number of fund managers using the VCC structure in Singapore is increasing due to its flexibility. According to the latest global asset management survey report released by MAS in 2022, Singapore has S$4.9 trillion of assets under management, with 76% of funds sourced from outside Singapore and 88% of funds invested in assets outside of Singapore (with the largest proportion invested in Asia Pacific ex-Singapore).

To set up or use a VCC fund, it needs to be managed by a Singapore-licensed fund manager. This requirement allows MAS to impose anti-money laundering rules and know-your-client regulations on the fund manager, ensuring the credibility of Singapore-sourced investment funding for the region. The VCC fund structure can be used for both wealth management and fund management.

Other than for Private Wealth uses, we will cover in this article seven uses of the Singapore VCC in the context of mergers and acquisitions (both private and public M&As).

.

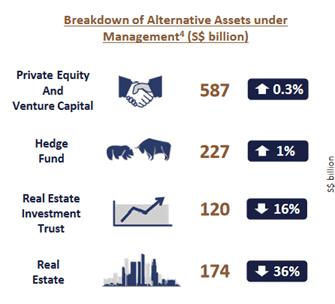

Extracted from the MAS Asset Management Survey 2022

1. VCC Funds are not bound by strict capital controls rules imposed on Singapore Companies under Company Law

Under Singapore law, a private limited company has strict capital rules to protect third-party creditors. Consequently, there are stringent requirements for shareholders before distributions can be made. Typically, distributions come from dividends out of profits or via capital reduction, which can be a lengthy process. These capital rules are less useful for investment funds, which usually involve sophisticated investors seeking more flexibility in terms of entry and exit.

Investing via a normal Singapore private limited company typically means profit extraction is limited to dividend distributions in profitable years. In contrast, a VCC fund allows for more flexibility, enabling profit distribution through the redemption of participating shares (from both profits and capital). This flexibility is advantageous for M&A activity, as it allows for quick repatriation of profits when an investment matures, aiding large multinational companies in capital redeployment after a major deal.

2. Anonymity of Shareholders

In Singapore, like in Hong Kong, shareholders of a private limited company are a matter of public record. However, investors in a VCC fund are not publicly listed. Fund managers are required to conduct necessary anti-money laundering and know-your-client checks to comply with Singapore law and MAS regulations. This feature is increasingly attracting investors to use the VCC fund structure to hold their assets.

3. Tax Benefits of using the VCC Fund

Most fund managers take advantage of the S13O/S13U tax incentive when setting up a VCC fund, resulting in a 0% tax rate on the fund, making all investment profits tax-free. Given the complexity of tax law, seeking proper tax advice is recommended.

A VCC fund, being Singapore-domiciled, benefits from Singapore’s double tax treaties, which are beneficial for structuring cross-border investments and profit extraction in M&A activity. Singapore’s extensive double taxation agreements are a significant consideration for global MNCs in their tax planning strategies.

4. Using the Variable Capital Company Fund to do acquisition of listed companies

Some corporate investors prefer not to disclose their identity when bidding for a major listed company. Using a VCC, subject to detailed structuring finance and legal advice, may be able to take advantage of such anonymity. The VCC structure offers more flexibility when investing in listed companies or conducting corporate transactions, whether as a controlling shareholder or otherwise. This area requires some structuring legal advice, but it sufficient to say there are ways to setup structures to aid potential buyers when they are doing listed investments.

5. US – China Geo-Political Tensions

Due to US-China tensions, many companies need to split their supply chains to cater to clients in both markets. Utilising a Singapore Variable Capital Company Fund structure as part of a holding structure for a multi national company can help address some of these concerns. Detailed structuring is required, but this approach can help manage cross-border M&A issues. Using a VCC Fund as part of an overall M&A planning strategy for global supply chains is key in Singapore. Some MNCs can mix this with the Global Trader Program and other schemes in Singapore to move their business operations to Singapore.

We have received many recent queries from clients on how to restructure their global holding structure and have shared with them some ways to restructure their global operations in the face of this change in political climate.

6. Using a Singapore Variable Capital Company as part of Profit Holding Structure and the need to separate ownership from control

While a Singapore trust structure is useful for succession planning, it is not ideal for operating companies since trustees typically avoid liability when a business starts losing money. A Singapore VCC structure, as part of a larger family office setup, can separate ownership from control.

From a tax perspective, if control is separated from ownership, shareholders might not be taxed in their home country on profits held by the VCC, if no fund distributions are made. (You will need to get tax advice on each of your situation as each situation is different) Additionally, profitable companies can be listed in offshore markets like NASDAQ, NYSE, or the Singapore or Hong Kong Stock Exchanges, enhancing listing opportunities.

7. Singapore – Good stable politics, place for MNCs, command and control centre/ global financial centre

Singapore is known for its political stability and hosts many multinational banks and institutions, making it a trusted global financial center. This stability facilitates multi-generational asset planning and investment from Singapore.

Many global conglomerates are using the Singapore Variable Capital Company Fund structure to organize and control their pan-Asian or global investments from Singapore, leveraging its strong reputation and extensive network of double taxation treaties.

In conclusion, the Singapore VCC structure offers numerous benefits for companies looking to grow and expand without sacrificing control. It provides anonymity for global deals, leverages Singapore’s reputable standing, and taps into its extensive double taxation treaty network. Consider using a VCC for your multinational or large conglomerate expansion, and you may find significant advantages beyond just tax savings.

==================================================================================================

We work with a large well known Singapore law firm. If you need to engage a Singapore lawyer to advise you on your private wealth matters, please click here to schedule a complimentary meeting with our lawyers.

我们与新加坡一家知名的大型律师事务所合作。如果您需要聘请新加坡律师为您提供私人财富方面的建议,请点击此处安排与我们律师的免费会面。

http://www.SingaporeLegalPractice.com is a corporate law and commercial law educational website headquartered in Singapore which aims to demystify business law and 新加坡商业法 for SME Company Owners, Startup Founders and 新加坡新移民老板。The information provided on this website does not constitute legal advice. Please obtain specific legal advice from a lawyer before taking any legal action. Although we try our best to ensure the accuracy of the information on this website, you rely on it at your own risk. Click here to signup for our newsletter today to be kept updated on the latest legal developments in Singapore.

==================================================================================================

Signup for our website newsletter to be updated on the latest in Singapore law!